In Today’s Issue:

Hemi‘s 2025 Recap: A Year of Milestones

This Week’s Hemi Yield Opportunities

Scroll to the bottom for the answer.

Q: What economic mechanism ensures Bitcoin remains secure even as block subsidies decline over time?

2025 marked a year of innovation and deployment for the Hemi ecosystem. In this year’s final issue, we look back at the team’s achievements across mainnet launch, ecosystem expansion, and laying the groundwork for institutional adoption.

Hemi Begins The Year With Community Momentum

Hemi entered 2025 with a verified, sybil-resistant user base and one of the most active Bitcoin-aligned testnets in the ecosystem.

DEMOS onboarded 85,000 verified users, while Open Season stress-tested the network by consuming 88% of Sepolia gas at peak, setting a testnet fee record:

In March 2025, the event was commemorated via a testnet launch of “I Broke Sepolia” NFTs.

Hemi Mainnet Goes Live

Hemi mainnet launched in March with over 50 partners integrated from day one and rapidly scaled to $1.2B in total value locked.

The network emerged as one of the most active Bitcoin L2 environments, validating demand for programmable, native Bitcoin-integrated DeFi.

Building With the Ecosystem: DeFi, Infra, and Access

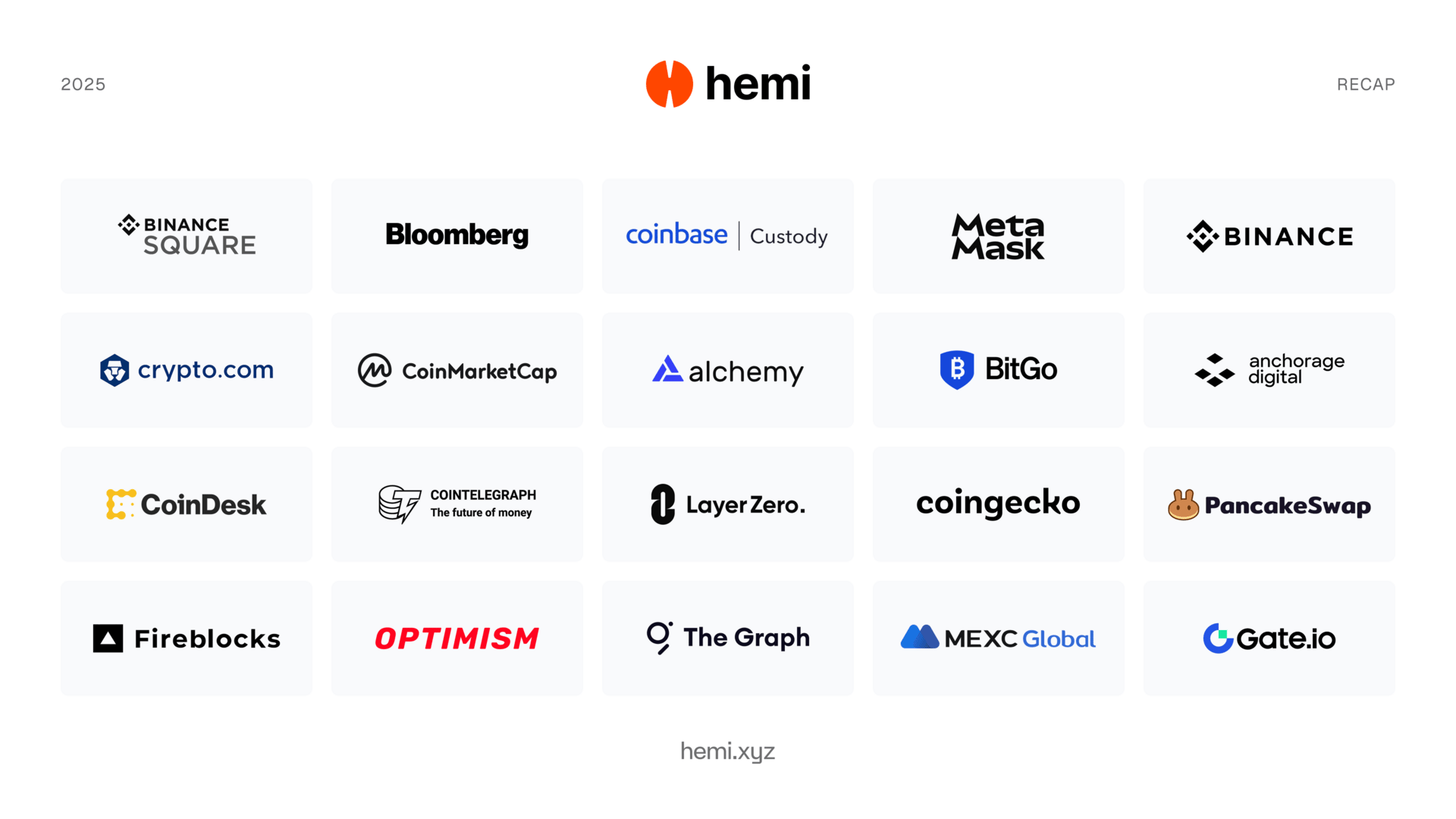

Throughout 2025, Hemi expanded its ecosystem across oracles, lending, perps, crosschain routing, custody, and developer infrastructure.

Integrations with partners like RedStone, The Graph, Morpho, Gearbox, LI.FI, Safe, and others broadened both user access and institutional readiness.

$HEMI Token Launch and Binance Listing

Hemi closes a $15M growth round led by Binance Labs, bringing total venture backing to approximately $30M ahead of the $HEMI token launch.

On August 29, 2025, the $HEMI token is listed on Binance, the world's largest cryptocurrency exchange.

Ongoing infrastructure integrations, and partnerships with Infura and Dominari Securities signaled institutional interest in Bitcoin-native DeFi.

Hemi Publishes Its Economic Model

The first phase of Hemi’s four-phase economic model launched in October.

Protocol fees convert to staking rewards for veHEMI and hemiBTC participants.

The system introduced fee burns, economic security incentives, and the foundation for protocol-owned liquidity and dual staking.

Ahead: Infrastructure for Activated Bitcoin

Hemi closed 2025 focused on scaling Bitcoin-native programmability, developer tooling, robust liquidity design, and long-term ecosystem resilience.

The roadmap ahead centers on making Bitcoin productive by default, without sacrificing transparency, security, or institutional trust.

Pool | APY/APR* | Asset | Begin Earning |

SushiSwapV3 HEMI-hemiBTC | 63.44% | HEMI, hemiBTC | |

SushiSwapV3 WETH-HEMI | 58.22% | WETH, HEMI | |

SushiSwapV3 HEMI-USDT | 42.54% | HEMI, USDT | |

SushiSwapV3 HEMI-USDC.e | 42.37% | HEMI, USDC.e | |

SushiSwapV3 WETH-MSETH | 40.5% | WETH, MSETH |

*APY/APR varies by strategy, custody jurisdiction, and market conditions. |

A: Transaction fees, which increasingly compensate miners as issuance decreases, aligning network security with real economic demand for block space.

The Hemi team wishes everyone happy new year and looks forward to continuing to build the future of productive Bitcoin together.